Are you searching for ways to reduce your car insurance expenses? If you're aiming to cut down your premiums while keeping your coverage intact, it's essential to steer clear of common pitfalls. Here are some mistakes you should avoid: 1. Overlooking Competitors: Regardless of whether you're purchasing a new car or simply renewing your existing policy, it's crucial to compare multiple insurance quotes. This ensures you find the most affordable rates available. 2. Paying Too Much for Older Cars: Keep an eye on the current value of your vehicle. As your car ages, it may no longer be worth the additional expense of comprehensive or collision coverage. In such cases, it's better to opt for simpler policies. 3. Failing to Update Your Insurance Company: Life changes like moving closer to work or transitioning to remote work can impact your insurance needs. Always inform your provider about significant lifestyle shifts, as they might adjust your policy accordingly. 4. Unnecessary Towing Coverage: Unless you frequently encounter car troubles, towing services may not be necessary. Paying directly for roadside assistance is often more cost-effective. 5. Speeding and Reckless Driving: Speeding tickets can significantly hike up your insurance premiums. Driving responsibly reduces the risk of accidents and keeps your rates stable. 6. Ignoring Discounts: Many insurance providers offer various discounts. Don't hesitate to inquire about any available savings opportunities tailored to your situation. Avoiding these errors can lead to substantial savings. Additionally, maintaining your vehicle through regular maintenance, such as oil changes and using authentic parts, can further reduce related costs. For example, using original Toyota parts can enhance vehicle performance and longevity. For more tips on saving money on car insurance, check out related posts like "How to Shop for Car Insurance And Save Money" or "Avoid These 5 Costly Mistakes When Buying Auto Insurance." These resources provide valuable insights into optimizing your coverage and cutting unnecessary expenses. Remember, managing your car insurance effectively requires attention to detail and staying informed about your options. By taking proactive steps, you can enjoy peace of mind while keeping your costs under control. Automatic Tunnel Car Wash Machine Automatic Tunnel car wash machine, Automatic car wash systems,Automatic pressure car wash machine Zhengzhou Shinewash Technology Co.,Ltd , https://www.shinewashtech.com

Related Posts

How To Shop For Car Insurance And Save Money

How To Shop For Car Insurance And Save Money  Signs It’s Time To Switch Auto Insurance Carriers

Signs It’s Time To Switch Auto Insurance Carriers  Avoid These 5 Costly Mistakes When Buying Auto Insurance

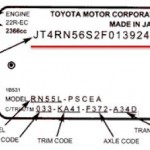

Avoid These 5 Costly Mistakes When Buying Auto Insurance  Understanding Your Vehicle Identification Number (VIN)

Understanding Your Vehicle Identification Number (VIN)  Edmunds.com – A Great Place For Car Buyers, Owners Or Enthusiasts!

Edmunds.com – A Great Place For Car Buyers, Owners Or Enthusiasts!  What Is The True Cost Of A Car?

What Is The True Cost Of A Car?